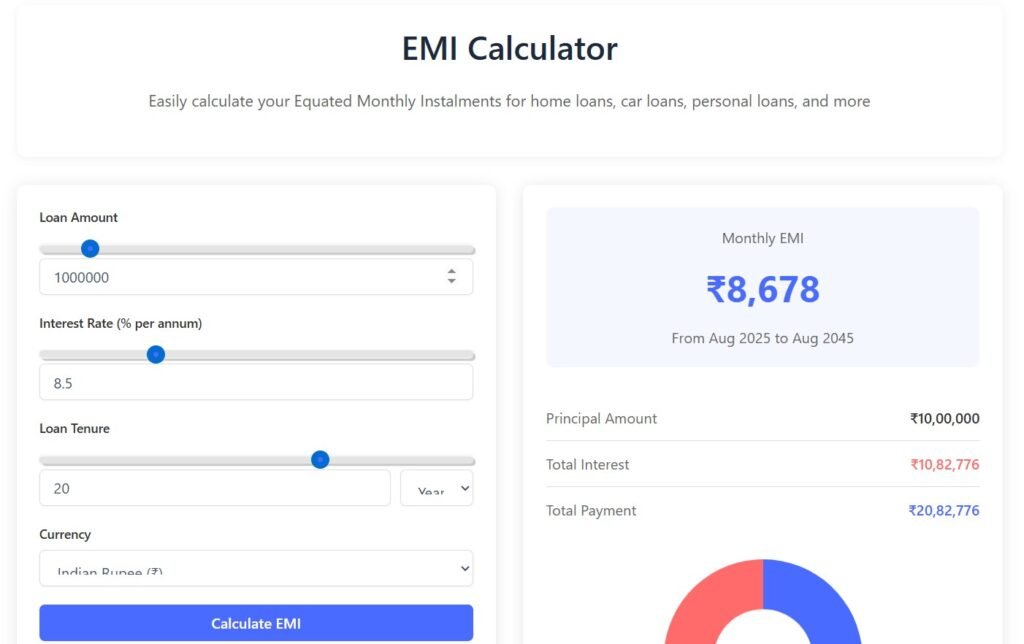

EMI Calculator

Easily calculate your Equated Monthly Instalments for home loans, car loans, personal loans, and more

Prepayment Options

See how your EMI is divided between principal and interest over the loan tenure.

Detailed schedule showing how each payment affects your loan balance.

| Month | Payment | Principal | Interest | Balance |

|---|

Make extra payments to save on interest and pay off your loan faster.

Interest Rate Comparison

Accurate EMI Calculation

Instantly compute your monthly EMI based on loan amount, interest rate, and tenure using the standard EMI formula for precise results.

Loan Breakdown & Schedule

Get a detailed breakdown of principal, interest, and total payment with a complete amortization schedule.

Interest Rate Comparison

Compare EMIs for different interest rates to see how they impact your repayment amount.

Prepayment Analysis

Calculate how lump sum prepayments or extra monthly payments can reduce your total interest and tenure.

Visual Insights

View interactive charts to visualize total interest paid and compare different loan scenarios.

Multi-Currency Support

Calculate EMI for loans in multiple currencies and choose tenure in months or years as needed.

How to Use the EMI Calculator

Enter Loan Details

Loan Amount: Use the slider or input your loan amount.

Interest Rate (%): Adjust the interest rate.

Loan Tenure: Choose months or years and set the duration.

Optional Features

Prepayment: Enter a lump sum amount and when you’ll pay it.

Extra Monthly Payment: Add extra EMI to reduce tenure.

Compare Interest Rates: Enter different rates to see EMI changes.

View Results

Monthly EMI: Instantly calculated.

Total Interest & Payment: Breakdown of costs.

Amortization Schedule: See payment-wise principal & interest.

Charts: Visualize interest vs. principal.

Adjust & Compare

Change values anytime to see updated results.

Use tabs to switch between Breakdown, Amortization, and Prepayment Impact.

📌 Frequently Asked Questions (FAQs) About EMI Calculator

1. ❓What is an EMI Calculator?

An online tool that helps you in calculating the Connected Monthly Installment (EMI) required to repay a loan is called an EMI Calculator. quickly compute exact monthly payments, it needs variables like the loan amount, interest rate, and duration.

👉 Try our EMI Calculator tool to get started.

📖 Learn more about how EMI is calculated from this RBI loan EMI guide.

2. ❓Why Should I Use an EMI Calculator Before Taking a Loan?

Using an EMI calculator allows you to:

Plan your monthly budget.

Choose the right loan tenure.

Compare EMI options from different banks.

📌 Use our internal SIP Calculator to plan your savings alongside EMI payments.

💡 BankBazaar EMI Calculator for more comparative results.

3. ❓Can I Calculate EMIs for Home, Car, and Personal Loans?

Yes! The EMI calculator can be used for all loan types:

🏠 Home Loans

🚗 Car Loans

💳 Personal Loans

Check out our helpful guide on home loan EMI planning to make better financial decisions.

🔗 Want to explore government-backed housing loan schemes? Visit PMAY (Pradhan Mantri Awas Yojan

check out:

4. ❓Is the EMI Calculator Result 100% Accurate?

While online EMI calculators are highly accurate, slight variations may occur due to:

Bank-specific processing fees.

Variable interest rates.

Still, tools like ours at Toolxi EMI Calculator provide 95–99% accuracy in real-time.

✔ Tip: Always verify the final EMI with your bank or lending institution.

5. ❓How is EMI Calculated Manually?

EMI is calculated using this formula:

Where:

P = Loan Amount

R = Monthly Interest Rate

N = Number of Monthly Installments

Don’t worry—no need to do the math. Just use our instant EMI calculator!