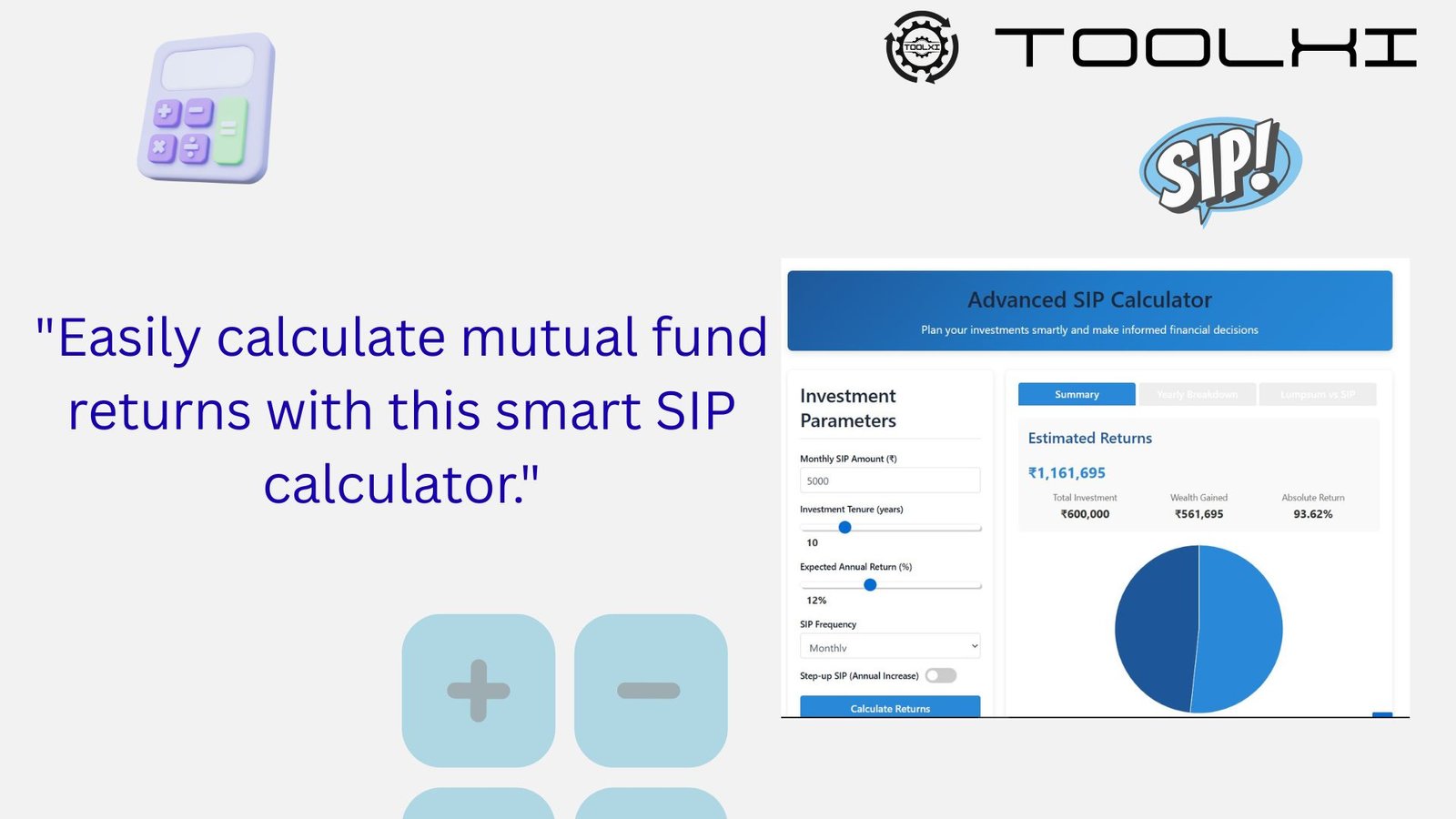

Advanced SIP Calculator

Plan your investments smartly and make informed financial decisions

Investment Parameters

Adjustments

Estimated Returns

Adjusted Values

Yearly Investment Growth

| Year | Invested | Interest | Total Value |

|---|

Lumpsum vs SIP Comparison

| Parameter | SIP Investment | Lumpsum Investment |

|---|---|---|

| Total Investment | ₹0 | ₹0 |

| Final Value | ₹0 | ₹0 |

| Wealth Gained | ₹0 | ₹0 |

| Absolute Return | 0% | 0% |

Note: Lumpsum investment assumes same amount as total SIP investment made at the beginning of the period.

Key Features

🔹 Accurate SIP Return Calculation

Estimate the future value of your investments with precision. Supports monthly, quarterly, and yearly SIP investments. Uses the compound interest formula to project returns.

🔹 Customizable Investment Parameters

Adjust investment amount, tenure, and expected rate of return to see different scenarios. Set step-up SIP options for increasing investments over time.

🔹 Graphical & Tabular Analysis

Get a detailed breakdown of your total investment, interest earned, and maturity amount. View interactive charts and tables for easy visualization.

🔹 Inflation & Tax Adjustment

Factor in inflation rates to see real purchasing power at maturity. Calculate post-tax returns based on your tax slab.

🔹 Lumpsum vs SIP Comparison

Compare returns from a one-time lumpsum investment versus a recurring SIP. Make the right investment decision based on your financial goals.

🔹 Easy to Use, Fast & Free!

100% online—no registration required. Instant calculations with accurate results. Perfect for investors, financial planners, and beginners.

Basic Calculation

Enter Your Monthly SIP Amount

In the “Monthly SIP Amount” field, enter how much you plan to invest regularly (e.g., ₹5,000)

Minimum amount is ₹500 (automatically enforced)

Set Investment Tenure

Use the slider to select how many years you plan to invest

Range is from 1 to 40 years

The value updates automatically as you move the slider

Enter Expected Annual Return

Use the slider to set your expected rate of return (1% to 30%)

For equity mutual funds, a typical range is 10-15%

For debt funds, consider 6-8%

Select SIP Frequency

Choose from:

Monthly (default)

Quarterly

Yearly

The calculator automatically adjusts calculations based on your selection

Click “Calculate Returns”

View your results instantly in the Summary tab

Advanced Features

Step-up SIP (Increasing Investments Over Time)

Toggle “Step-up SIP” switch to ON (blue indicates active)

Set Annual Increase Percentage

Enter how much you want to increase your SIP each year (e.g., 10%)

This helps account for salary increases and inflation

Adjustments for Realistic Planning

Inflation Adjustment

Toggle “Adjust for Inflation” switch to ON

Enter expected inflation rate (default is 6%)

View “After Inflation” value to see purchasing power of your returns

Tax Adjustment

Toggle “Adjust for Tax” switch to ON

Enter your applicable tax rate on capital gains

View “After Tax” value to see post-tax returns

Viewing Results

The calculator provides multiple ways to analyze your investment:

Summary Tab (Default View)

Pie chart showing investment vs returns

Key numbers: Maturity amount, total invested, wealth gained

Adjusted values for inflation and tax

Yearly Breakdown Tab

Line chart showing growth over time

Detailed table with year-by-year:

Amount invested

Interest earned

Total value

Lumpsum vs SIP Comparison Tab

Bar chart comparing SIP with equivalent lumpsum investment

Table showing key differences:

Total investment

Final value

Wealth gained

Absolute return

F&Q

does grow credit rs 1 for mutual fund SIP?

No, Groww does not give mutual fund SIPs a ₹1 credit. The minimum investment amount for the majority of mutual funds ranges from ₹100 to ₹500, depending on the fund. Advertisements may exist, but ₹1 SIP is not a standard feature.

For current offers, check Groww’s official page .

How much is 1000 SIP for 5 years?

Your total investment will be ₹60,000 if you use an investor plan (SIP) to invest ₹1,000 every month for five years. You can expect a maturity amount of approximately ₹81,000 to ₹85,000 if you assume an average yearly return of 12%.

A SIP calculator can help you accurately predict your returns based on your monthly investment, tenure, and expected rate of return.

How to Invest in a SIP Plan?

Investing in a SIP is simple and can be done in a few steps:

Choose a trusted platform like Groww or Zerodha Coin.

Complete KYC (you’ll need PAN, Aadhaar, and bank details).

Select your mutual fund based on goals and risk appetite.

Enter SIP amount, frequency, and start date.

Set auto-debit from your bank for monthly investments.

Use a SIP calculator to plan your investments and returns before selecting a fund.

How Much is ₹5,000 SIP per Month for 5 Years?

If you invest ₹5,000 a month for five years in SIP, your total investment will be ₹3,00,000.Your anticipated maturity value, assuming a 12% average annual return, will be between ₹4,00,000 and ₹4,30,000.

A SIP calculator that takes into account duration, monthly amount, and expected profits helps you understand returns.

Can I Get 15% Return on SIP?

15% yearly returns are possible, but not sure. The performance of the market and the kind of mutual fund you select—debt, mixed, which or equity—will determine this. Certain shares mutual funds have produced even greater long-term returns, according to historical statistics.

To find funds with potential, refer to Moneycontrol’s Top SIPs .